For this next article, I wanted to have a little fun. People have asked me about the name of this blog address, Finsights72. The reason I called it this was because of the Rule of 72, which calculates how long it will take an investment to double in value. So without further ado, let’s get into the Rule of 72.

The Rule of 72 is used in many disciplines, but in terms of the finance world, it is often used for investments. The formula is:

72/Expected rate of return = Years needed to double

The rule can be applied to compound interest rates, but it can also be applied to any factor that increases exponentially. Let’s say an investment will grow by 8% annually. Simply substitute that number into the formula for expected rate of return (don’t convert it to a decimal) and solve. So you would do: 72/8 = 9 years for the investment to double.

The rule can also determine long-term effects of your investments. Also, it can be used to see how long it will take the value of your money to halve with regards to inflation. If, for example, inflation is 4%, and you do 72/4 to get 18, you’ll figure out that it will take 18 years for your money to go down in value by a factor of 2 (provided inflation remains at that constant rate).

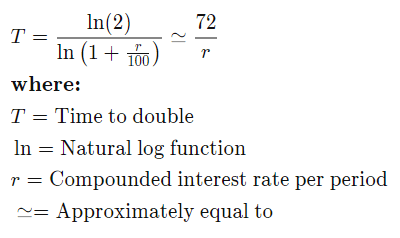

So, as you can see, this neat little formula is pretty useful. It’s not completely accurate, but it can serve as an approximation for a variety of situations. The more accurate formula is:

T = ln(2)/(ln(1 + r)), where r is the rate of return (this time as a decimal). If you use 8% again from the first example, you would first convert 8% to a decimal (0.08), and when you substitute and solve, you would get about 9.006, which is pretty close to the 9 we got using the Rule of 72.

I hope this was fun and shed some light on why I picked Finsights72 to be the address of this blog. Until next time!